Published: Feb 03, 2026

Generative AI solutions for the payments industry

As cross-border payment volumes grow, banks face rising manual effort, false positives, and compliance pressure. This article explores how NCS applies Generative AI, through its Payments Copilot, to automate workflows, improve decision accuracy, and strengthen regulatory resilience.

Key takeaways

- Cross-border payments remain operationally complex, with low straight-through processing rates and high manual effort driving cost and risk.

- Traditional rules-based compliance systems generate excessive false positives, slowing payments and straining operations teams.

- Generative AI enables more context-aware validation, screening, and reporting across the payments lifecycle.

- Banks can achieve productivity gains equivalent to 5.29 full-time roles per 10,000 transactions per day, improving throughput without increasing headcount.

- NCS’s Payments Copilot illustrates how banks can improve efficiency, strengthen compliance, and scale cross-border operations with confidence.

Why cross-border payments remain difficult to scale

Cross-border payments sit at the intersection of operational complexity, regulatory scrutiny, and rising customer expectations. Unlike domestic payments, they rely on fragmented data, multiple intermediaries, and jurisdiction-specific compliance requirements. As a result, straight-through processing rates remain low, with a significant proportion of transactions requiring manual review and intervention.

For large regional banks processing close to a million transactions daily, this complexity translates into thousands of alerts every month. Many of these alerts are false positives generated by rigid, rules-based systems that lack contextual awareness. Each alert demands human investigation, increasing cost, slowing payment flows, and exposing banks to operational risk. Over time, this manual burden constrains scalability and diverts skilled teams away from higher-value work.

The limits of traditional automation and rules-based controls

Conventional payment and compliance systems were designed for predictability. They rely on static rules, fixed thresholds, and predefined scenarios. While effective for basic controls, these systems struggle when faced with evolving transaction patterns, changing regulations, and increasingly sophisticated fraud and money-laundering techniques.

In areas such as sanctions screening and AML compliance, outdated rules generate millions of false positives annually, driving up investigation costs and creating bottlenecks across payment operations. The result is a compliance model that prioritises caution but sacrifices efficiency, speed, and customer experience. Addressing this imbalance requires systems that can interpret context, learn from historical outcomes, and support human judgement rather than overwhelm it.

Applying Generative AI across the payments lifecycle

Generative AI introduces a more adaptive approach to payment operations. By drawing on both structured and unstructured data, it enables systems to understand intent, detect anomalies more accurately, and automate routine decision-making while keeping humans in the loop.

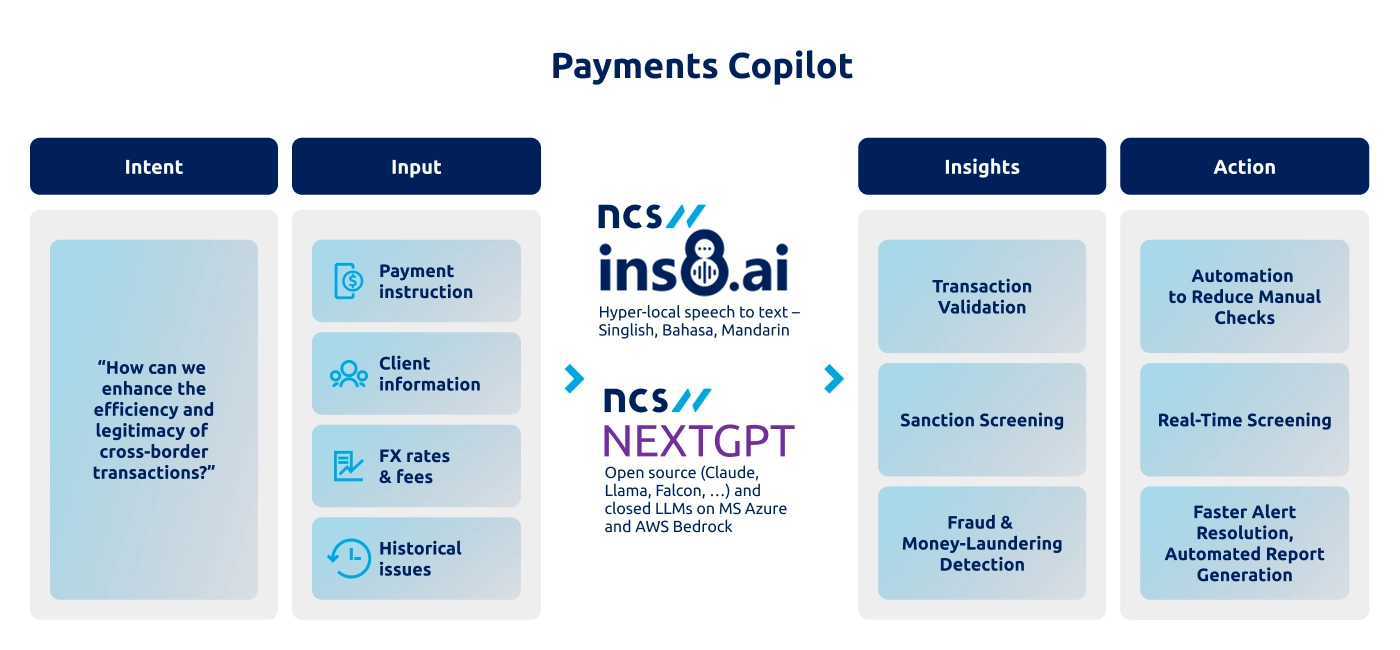

Figure 1: Overview of Payments Copilot.

Within the Payments Copilot, Generative AI supports the full cross-border payment lifecycle, from initiation through to reporting. It parses payment instructions, validates transaction details against client profiles, screens for sanctions and fraud risks, and automatically generates compliance reports. By referencing historical data, internal policies, and regulatory guidance, the Copilot reduces unnecessary alerts and accelerates processing without compromising oversight.

Targeted impact at each stage of the value chain

Each stage of the payment lifecycle presents distinct operational challenges. The Payments Copilot addresses these challenges with focused AI-driven capabilities that reduce manual effort and improve consistency.

Table 1: GenAI toolkit across the Payments value chain.

From automating data entry during initiation to accelerating validation, sanctions screening, and AML checks, the Copilot enables banks to reallocate resources more effectively. For ASEAN-based banks, this equates to freeing up the equivalent of approximately 5.29 full-time roles per 10,000 transactions per day across key processing stages, allowing teams to focus on higher-value, judgement-driven work while improving turnaround times and compliance outcomes.

Designing for trust, transparency, and usability

Beyond automation, the Payments Copilot is designed to support trust and explainability. Its interaction layer presents flagged transactions with clear contextual explanations, enabling operations and compliance teams to understand not only what was flagged but also why.

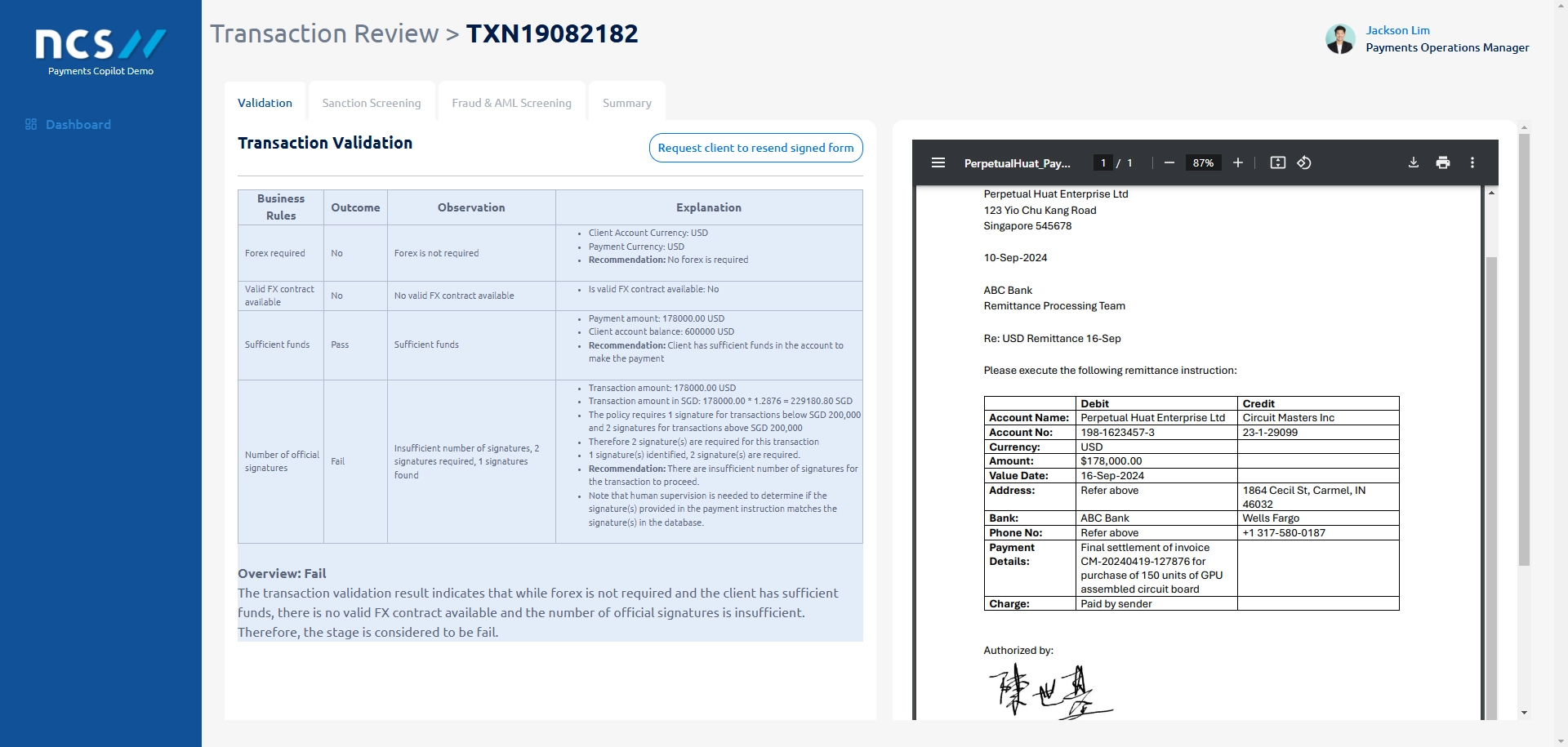

Figure 2: Side-by-side display of screening result and payment instruction in the Transaction Validation stage for easy reference and context.

This approach reduces investigation time, improves auditability, and supports more confident decision-making across teams. By making AI-driven insights accessible and interpretable, the Copilot strengthens governance rather than obscuring it.

Demonstrating enterprise-ready capability with NEXTgpt

The Payments Copilot is demonstrated through a working prototype at NCS’s customer experience centre, Tesseract. The prototype is powered by NEXTgpt, NCS’s enterprise accelerator for operationalising large language models across real-world use cases.

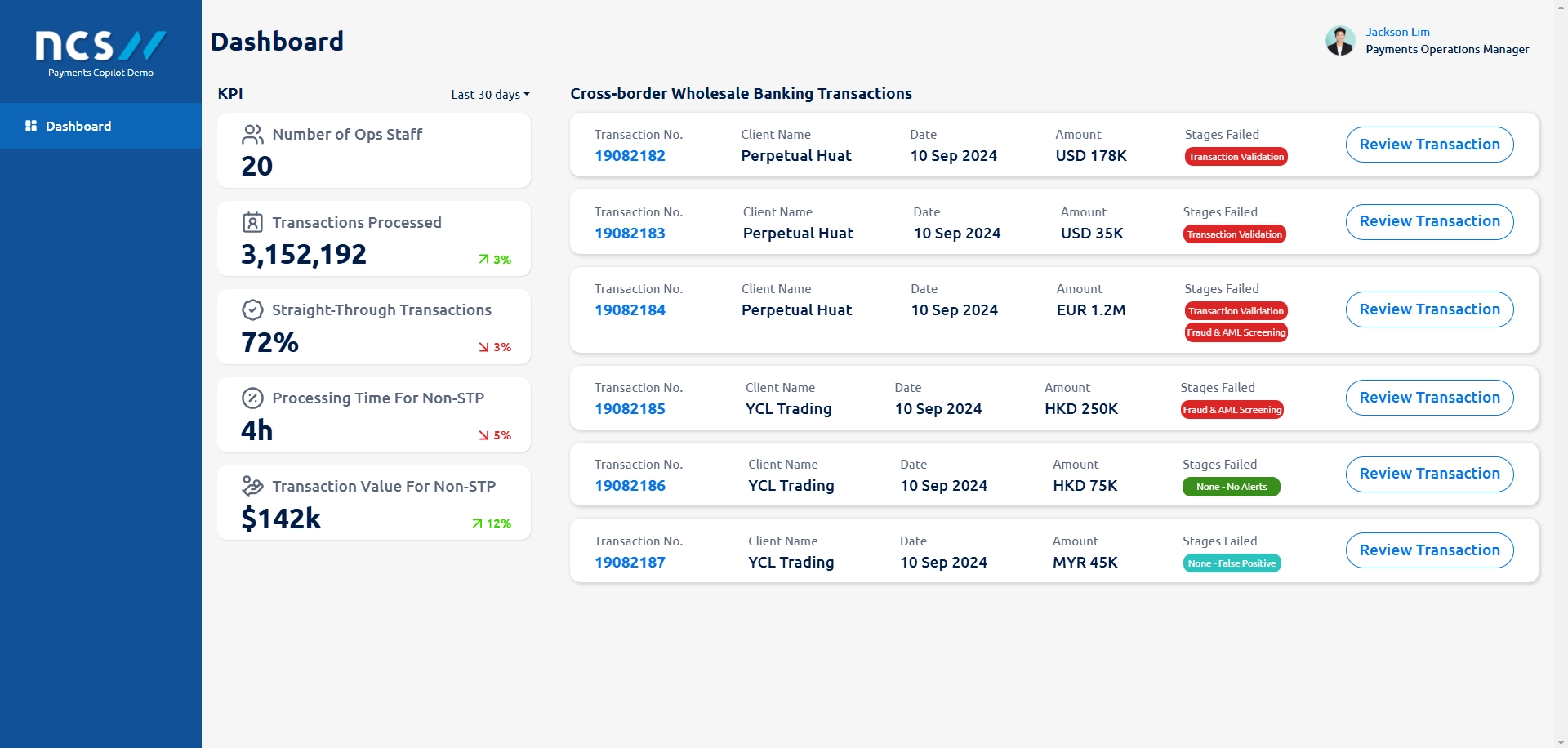

Figure 3: Payments Copilot dashboard.

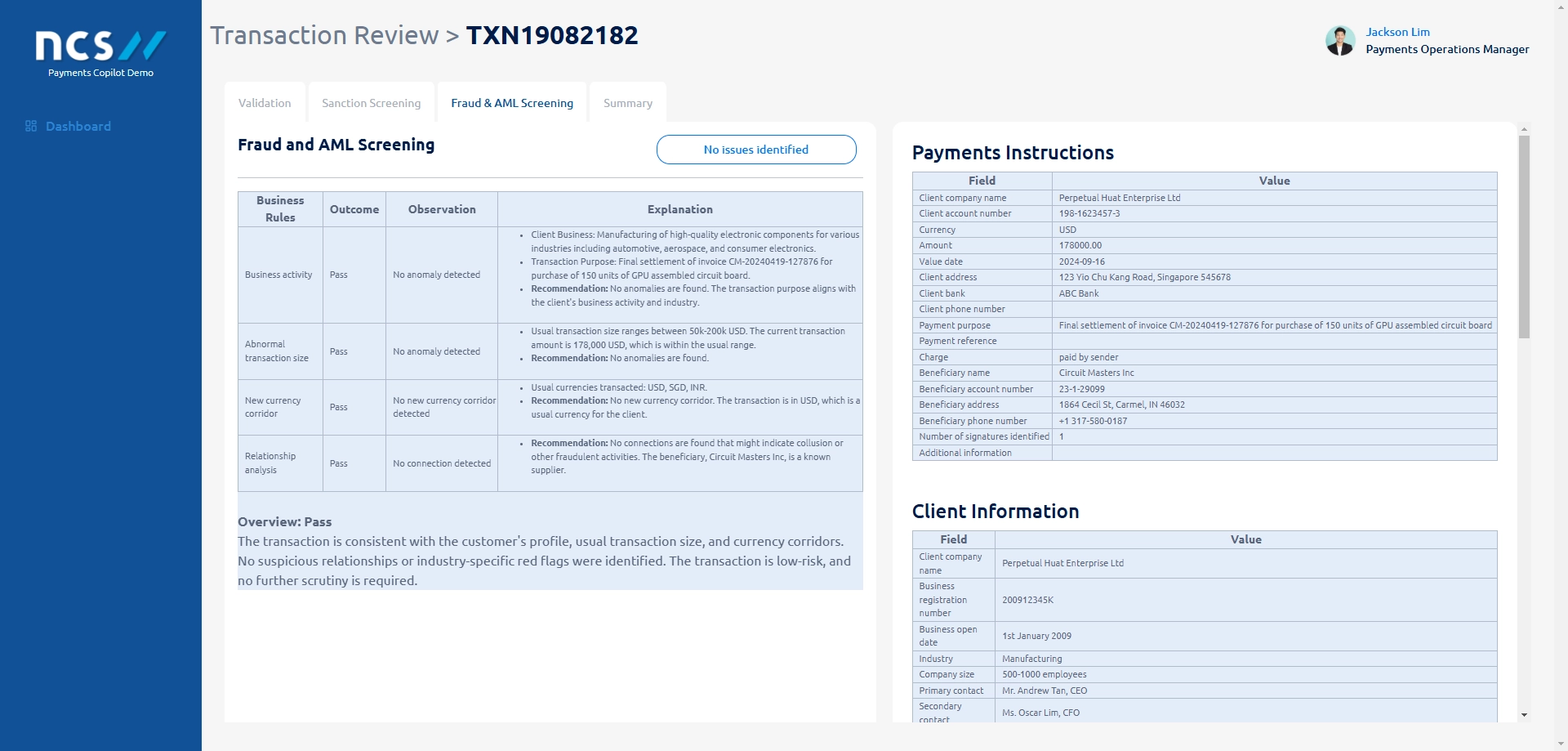

Figure 4: Fraud and AML Stage.

NEXTgpt provides a model-agnostic architecture that supports secure deployment, multimodal data ingestion, and integration with existing enterprise systems. This ensures that Generative AI can be applied safely, scalably, and in alignment with regulatory and operational requirements.

Turning complexity into confidence

Cross-border payments continue to challenge banks with high operational costs, regulatory complexity, and manual intervention that limits scale. Incremental improvements to rules-based systems are no longer sufficient. What is needed is a more adaptive, context-aware approach that can keep pace with rising transaction volumes while maintaining trust and compliance.

NCS’s Payments Copilot demonstrates how Generative AI can be applied responsibly to real-world payment operations. By automating routine tasks, reducing false positives, and providing transparent, explainable insights, banks can improve efficiency without sacrificing control. The result is a more resilient payments operation that enables teams to focus on higher-value work, strengthens regulatory confidence, and delivers faster, more reliable cross-border payment experiences.