Published: Aug 08, 2025

COBA bank mobile apps: Driving customer loyalty and retention

As mobile banking continues to dominate the financial services landscape, customer-owned banks face increasing pressure to meet rising expectations for digital experiences.

In this article, Greg Barnett, Digital Experience Director, NCS, and Andrew Carr, Financial Services Director, NCS, discuss how mobile banking applications influence customer perceptions, drive engagement, and impact retention, showing how stable, consistent app updates and user-centric design are essential in retaining customers and maintaining a competitive advantage.

The role of COBA members in Australia's banking landscape

COBA represents 56 member institutions, including mutual banks, credit unions, and building societies, collectively serving over five million Australians. These institutions are known for their community-based, customer-first ethos. As digital services become the primary channel for customer interaction, COBA members must ensure their mobile banking apps reflect the same quality and trustworthiness as their in-person services.

The state of mobile banking for COBA members

A review of app store ratings for COBA member apps shows averages ranging between 3.5 and 4.2 stars. This places many COBA institutions behind major banks and fintechs, which often score above 4.5 stars. Common user complaints include:

- App crashes and login issues following updates

- Outdated or confusing user interfaces

- Missing features like real-time notifications, biometric login, or wallet integration

Significantly, over 40% of negative reviews are linked directly to app updates, suggesting that a lack of robust quality assurance can severely impact customer trust and satisfaction.

Mobile banking as a driver for satisfaction and retention

Done well, mobile banking can be a strategic driver that enhances customer satisfaction and boosts retention – giving a competitive edge that can help set institutions apart and encourage loyalty. There are also risks with inaction and not providing an intuitive mobile banking experience for customers.

Customer satisfaction

The Australian Banking Association has reported that mobile banking apps received the highest customer satisfaction rating (89.6%) among all banking channels, surpassing internet banking, branch visits, and telephone banking. This reflects a broader shift in consumer preference toward self-service digital solutions that offer convenience and real-time access. However, digital satisfaction can decline for customers in financial distress, who may need more human support. For customer-owned banks, this suggests that while mobile apps are a powerful retention tool, they should be balanced with strong customer service and empathetic outreach strategies.

Mobile banking and loyalty

A joint report by Experian and Moneythor found that 74% of Australians consider the quality of their mobile banking app to be a significant factor in deciding whether to stay with or switch financial institutions. Additionally, over half of Australians use their banking app between three and ten times per week, highlighting how deeply embedded mobile banking is in daily financial routines. The report emphasises that apps now represent the primary customer touchpoint and a major driver of loyalty. Banks with unstable or underperforming apps risk losing customers quickly, while those that offer consistent, intuitive digital experiences are more likely to retain and grow their user base.

Retention through digital capability

A separate study in the Journal of Economics, Finance and Accounting Studies found that mobile app quality plays a central role in customer satisfaction and retention. Banks that invested in feature-rich, well-maintained apps saw higher retention rates and more frequent app usage, demonstrating the financial impact of digital excellence. Simply offering a mobile app is no longer enough; delivering a seamless and tailored digital experience is critical to retaining today’s mobile-first customers.

The cost of poor mobile apps to COBA members

Across the board, app store reviews reveal that users are particularly sensitive to app updates. Negative experiences post-update often lead to a barrage of low ratings and frustrated feedback. This is not just an image problem as it translates into:

- Increased support costs due to higher volumes of troubleshooting requests

- Reduced customer trust and satisfaction

- Declining retention, especially among tech-savvy users who expect smooth digital experiences

Maintaining a stable update pipeline with rigorous testing, rollback mechanisms, and clear communication about changes is critical for COBA members.

What can COBA members do to improve their mobile apps?

To improve app performance and increase customer retention, COBA members should:

- Prioritize update stability: Implement automated and manual testing pipelines to ensure updates do not introduce regressions.

- Invest in UX/UI improvements: Adopt a human-centered design process to enhance usability and engagement.

- Communicate clearly: Use in-app alerts and changelogs to explain updates and manage expectations.

- Solicit and act on feedback: Create structured channels for users to report issues and suggest improvements.

- Benchmark and learn: Regularly evaluate app performance against leading banks and digital-first competitors.

Digital trust is customer trust

Mobile apps have become the front door to banking. For COBA members, delivering a consistent, secure, and intuitive mobile experience is essential. As the financial services industry continues to digitise, mobile app quality will increasingly determine whether customers stay or leave.

How NCS can help

To meet these demands, COBA members can benefit from partnering with NCS.

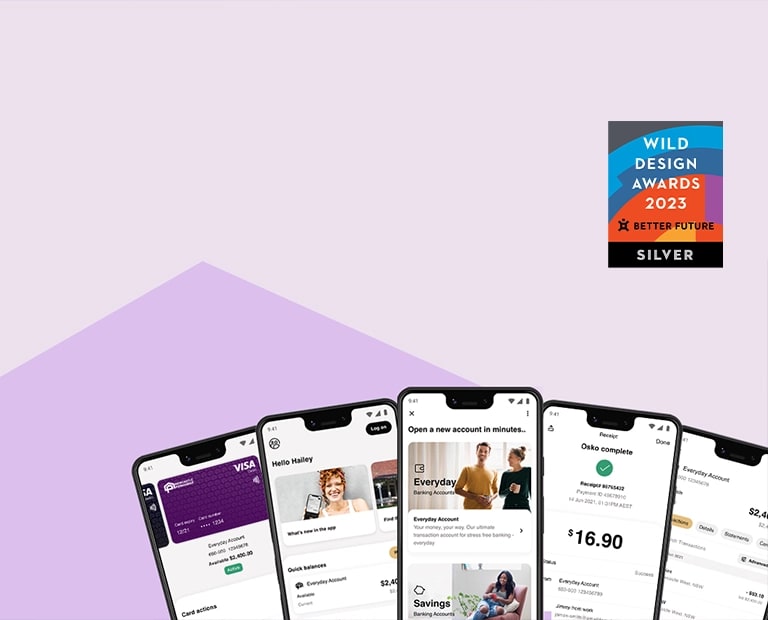

Our team has a track record of delivering award-winning mobile applications to support financial services businesses. With expertise in app deployment, UX design, and performance, NCS can help with building mobile experiences that drive engagement and loyalty.

Investing in mobile excellence, backed by expert support, is no longer optional. It’s a strategic step toward long-term customer retention and growth. Is your team ready to invest? Reach out for a conversation today